Case study: How Ostium powers real-time trading with Ormi

Ostium processes over $100M in daily trading volume on Arbitrum and depends on real-time indexed blockchain data. After outages and missing blocks from other providers, they adopted Ormi’s subgraphs to ensure fresh, consistent, and complete data for all trades.

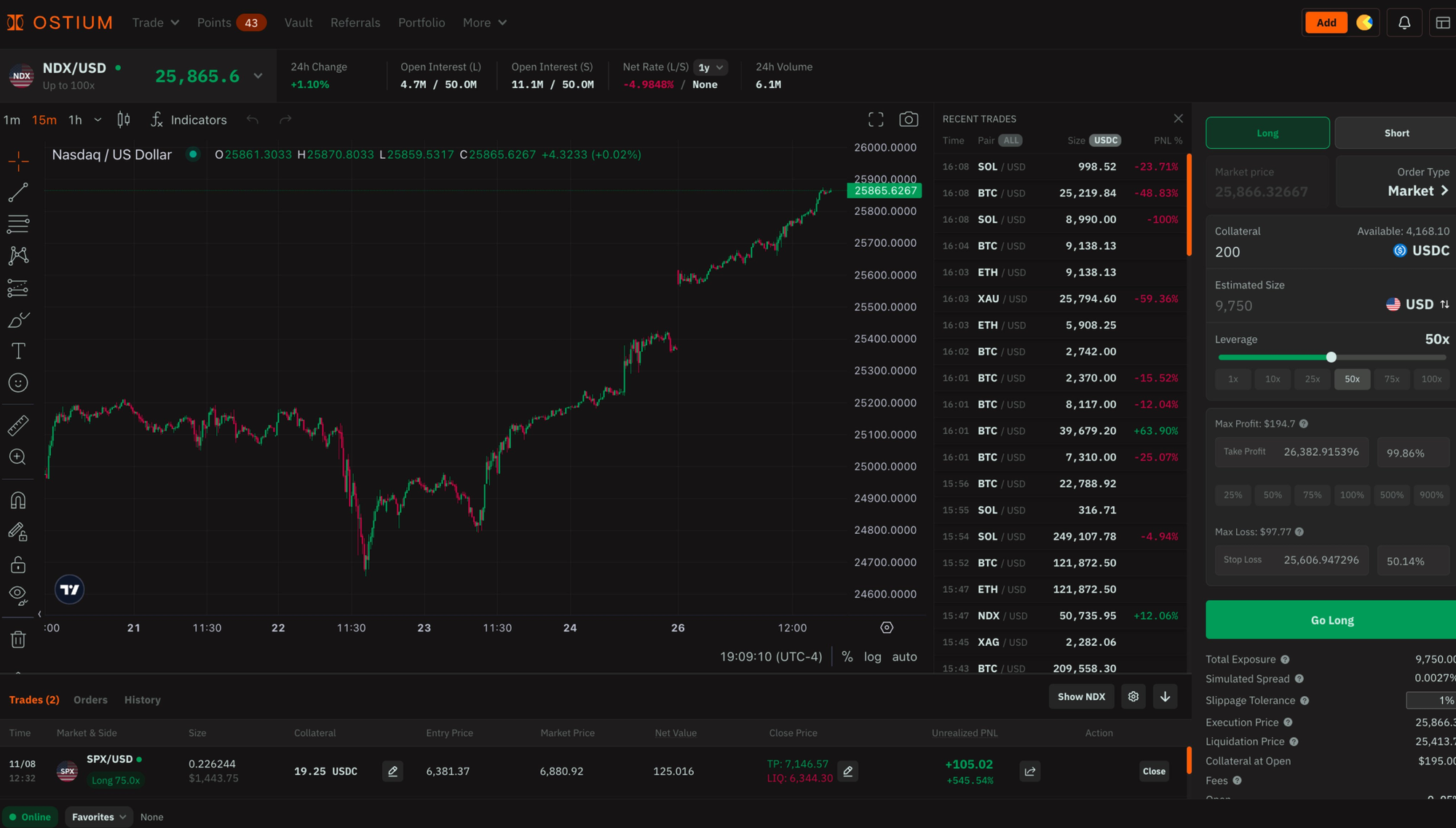

Ostium is a decentralized trading platform bringing global markets like oil, gold, ad equities on-chain on Arbitrum.

- Handles $100M+ in daily transaction volume

- 16,000+ traders

- $27B+ in cumulative trading volume

For Ostium’s traders, every millisecond matters. Prices need to reflect the latest market conditions, trades must appear the moment they’re executed, and data consistency is non-negotiable.

Even a brief delay or a missing block can lead to incorrect prices being displayed, positions not updating, or trades being executed on stale data, each of which can result in real financial losses for users operating at high leverage.

“For our traders, accuracy and uptime are everything. We learned the hard

way that latency and uptime don’t tell the full story. Missing blocks and

stale data caused trades to disappear, and those gaps have cost us real

money. With Ormi, our data stays fresh, consistent, and at the tip of the

chain, even when activity spikes.”— Marco Antonio Ribeiro, Founder & CTO

The challenge

Ostium’s business depends on real-time data. Even small gaps in indexing, like trades disappearing from the frontend, undermine user experience, trust, and risk financial loss.

When recurring issues with outages and missing blocks from other providers disrupted their frontend, Ostium turned to Ormi to deliver the reliable, high-throughput performance their platform requires.

Two of their providers struggled with outages during times of high traffic. Another failed to consistently serve blocks, resulting in incomplete data and missing trades.

Neither latency guarantees nor uptime SLAs prevented the real problem: data freshness and completeness. What Ostium needed wasn’t just speed, but an infrastructure that could deliver fresh data consistently, reliably, and at scale.

The solution

Ostium partnered with Ormi to deploy a custom indexing environment as their primary source of truth, backed by a secondary shared environment for redundancy.

This setup gave them:

- Custom environment: Highly optimized, from RPC ingestion with failover proxies, customized indexing logic, and query management, to ensure that data stayed aligned with the chain head even under heavy load.

- Consistency under spike: Real-time subgraphs that kept indexing within 10 blocks of the tip of the chain, even during periods of extreme volatility.

- Redundancy by design: Automatic failover to a secondary environment if the primary experiences issues, keeping the platform online without disruption.

The results

By adopting Ormi as their core indexing provider, Ostium eliminated the missing data and invisible downtime they had faced with other platforms. Instead of debugging and chasing missing blocks, their engineering team can focus on product enhancements since:

- Trades are visible on the frontend, even during periods of high volatility.

- Balances and positions are available in real-time and aligned with the tip of the chain.

For a platform pushing the boundaries of intraday leverage and controlled risk for on-chain equity trading, trust in the data layer is everything.

As chains like Arbitrum get faster and mainstream adoption drives surging workloads, indexing is no longer just a background concern. It is the foundation of user experience.

Related readings: Why a fast blockchain isn’t truly fast if its data can't be indexed fast enough.

About Ostium

Ostium is a leveraged trading platform where users can long or short exposure to Real World Assets like stocks, commodities, indices, and currencies. It uses synthetic perpetuals to enable on-chain trading to eliminate the need for wrapped or tokenized versions.

About Ormi

Ormi is the next-generation data layer for Web3, purpose-built for real-time, high-throughput applications like DeFi, gaming, wallets, and on-chain infrastructure. Its hybrid architecture ensures sub-30ms latency and up to 4,000 RPS for live subgraph indexing.

With 99.9% uptime and deployments across ecosystems representing $50B+ in TVL and $100B+ in annual transaction volume, Ormi is trusted to power the most demanding production environments without throttling or delay.